Toilet: Ek Prem Katha Tax Free In UP: Here's How The GST Calculation Works On Ticket Prices!

Actor Akshay Kumar’s latest release, Toilet: Ek Prem Katha that highlights the issue of open defecation in rural India, continues to roar at the box office a week after its release. The film was declared tax free in Uttar Pradesh a week ahead of its release, had a whopping opening weekend with Rs 51.45 crore, and has so far collected Rs 89.95 crore .

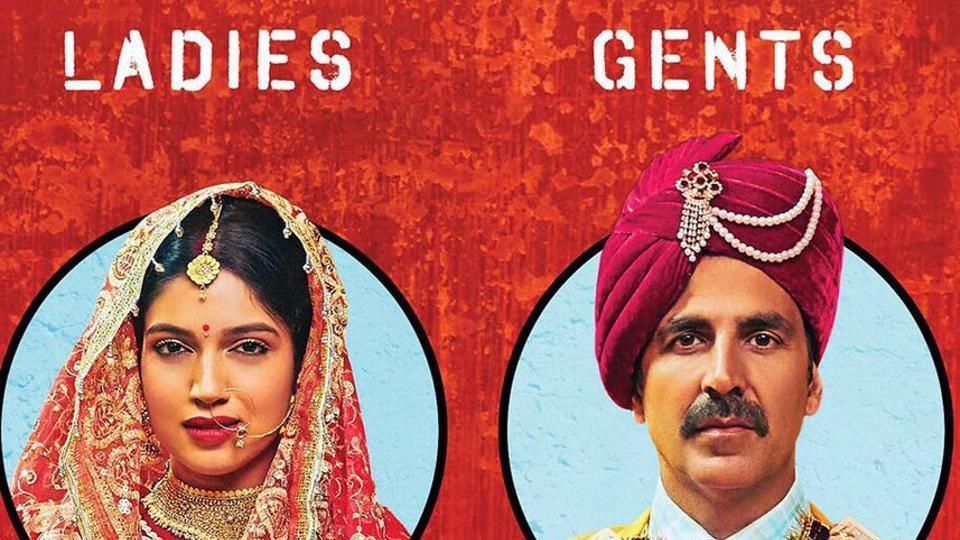

Interestingly, Toilet: Ek Prem Katha happens to be the first movie that has been made tax free post government introduced GST (Goods and Services Tax). The announcement was made by CM Yogi Adityanath, on August 4, when star cast of the film — Akshay and Bhumi Pednekar visited Luckow to promote their film in a private school.

While viewers might not expect or understand much of a difference here, we ask trade analysts how the calculations are done post GST.

So here is how it goes: GST has two components — central share and state share. If the ticket prices are Rs 100 or below that, GST charged on each ticket is 18%, and on tickets priced above Rs 100, GST is 28%. And if any state declares a film tax free, it has the authority to only waive off the state GST, which is half of the total GST charged — 9% and 14% respectively depending upon the ticket price.

Sharing further insight into how things change post GST is levied, trade expert Sanjay Mehta explains, “So only the state GST is set aside by the state government and central share is charged. [Also] the exhibitor does not charge the cine-goer for the exempted tax, but he has to deposit an equivalent amount with the state government or with the state en-casher and then he gets an adjustment or a rebate later. So, cine-goers are getting half of the benefit.”

According to trade analyst and box office expert Atul Mohan, the entertainment tax that was applicable on movie tickets sold in UP was normally between 40-45% before GST was introduced and it varies from one state to the other. So, whenever a film was made tax free earlier, that whole percentage used to get waived off.

“But even now, if you calculate, the 40% has come down to 28% or 18%, so there still is additional 12% and 26% relief [respectively] that is there for audience. However, it’s important to note here that this benefit has to be passed on to the audience, so usually when the film is declared tax free, the multiplexes hike the ticket price, so that they can maximize their profits. So for instance, a ticket priced at Rs 150 before the film goes tax free, will be increased to Rs 200 once it is declared tax free,” says Mohan.